JA Teens & Retirement Insights

Author: Hannah Henry

Work Readiness

Published:

Tuesday, 09 Apr 2019

Sharing

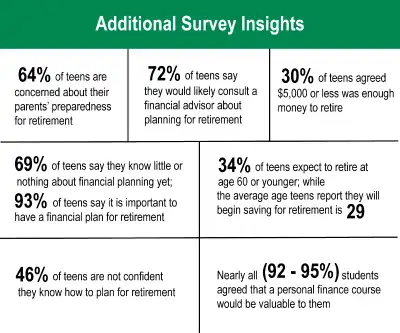

A new survey by Junior Achievement USA and AIG finds that nearly two-thirds (64 percent) of teens are concerned about their parents' preparedness for retirement while demonstrating a lack of education about their own. Sixty-nine percent of young adults ages 13-18 say they know little or nothing about financial planning.

When asked what they plan to do after they retire, teens cited traveling, hobbies such as golf or crafts, volunteering, and splurging on RVs or vacation homes as their top choices. More than a third (34%) of respondents think they will retire at age 60 or younger; however, one-third believe they will need less than $5,000 saved to retire and on average the teens plan to start saving for retirement at age 29.

In addition, 46 percent of teens are not confident they know how to plan for retirement. But teens' lack of understanding about financial and retirement planning does not translate into a lack of understanding about the imperativeness of planning. Ninety-three percent say it is important to have a financial plan for retirement, and 92 percent find value in taking a personal finance class in high school.

When asked to identify descriptions and benefits of financial products such as 401ks, annuities, and social security, nearly half (49%) were able to correctly match 401ks, one-third (33%) were right about annuities, and less than two-third (61%) about Social Security. Definitions, though, are just the start of any education process and help is needed in the application: While many could define an annuity, less than one-quarter (21%) of teens identified annuities as a protected source of lifetime income compared to bank deposits, stocks and mutual funds—none of which can provide protected income that cannot be outlived. And only about half (51%) were somewhat confident that Social Security will still exist when it's time for them to retire.

To gain the knowledge they need for information about investing for retirement, teens say they would first go to their parents, closely followed by a financial advisor or banker, other family member, teacher, or friend.

Methodological Notes:

The JA/AIG Survey was conducted by Wakefield Research (www.wakefieldresearch.com) among 1,000 nationally representative U.S. teens, ages 13-18, who are not currently enrolled in college, between August 13 and August 20, 2018, using an email invitation and an online survey. Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. For the interviews conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 3.1 percentage points from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.

About AIG

American International Group, Inc. (AIG) is a leading global insurance organization. Founded in 1919, today AIG member companies provide a wide range of property casualty insurance, life insurance, retirement products, and other financial services to customers in more than 80 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock Exchange and the Tokyo Stock Exchange.

We use cookies to provide you a personalized experience. How we do this is by analyzing user behavior on our site and sharing data with our advertising and analytics partners. You consent to our cookie policy if you continue to use this website.